Budgeting is often misunderstood as a restrictive or tedious activity, but in reality, it is a powerful tool that gives you financial control and peace of mind. Creating a personal budget doesn’t have to be complicated, and once in place, it helps you make informed decisions, avoid debt, and plan for the future.

Here’s how to create a budget that actually works—even if you’ve never done one before.

Understand Why You Need a Budget

Before diving into spreadsheets or apps, it’s important to understand the purpose of a budget. It’s not about depriving yourself—it’s about:

- Knowing where your money is going

- Being intentional with your spending

- Reducing financial stress

- Reaching short- and long-term goals

When you see budgeting as a tool for freedom, not restriction, you’re more likely to stick with it.

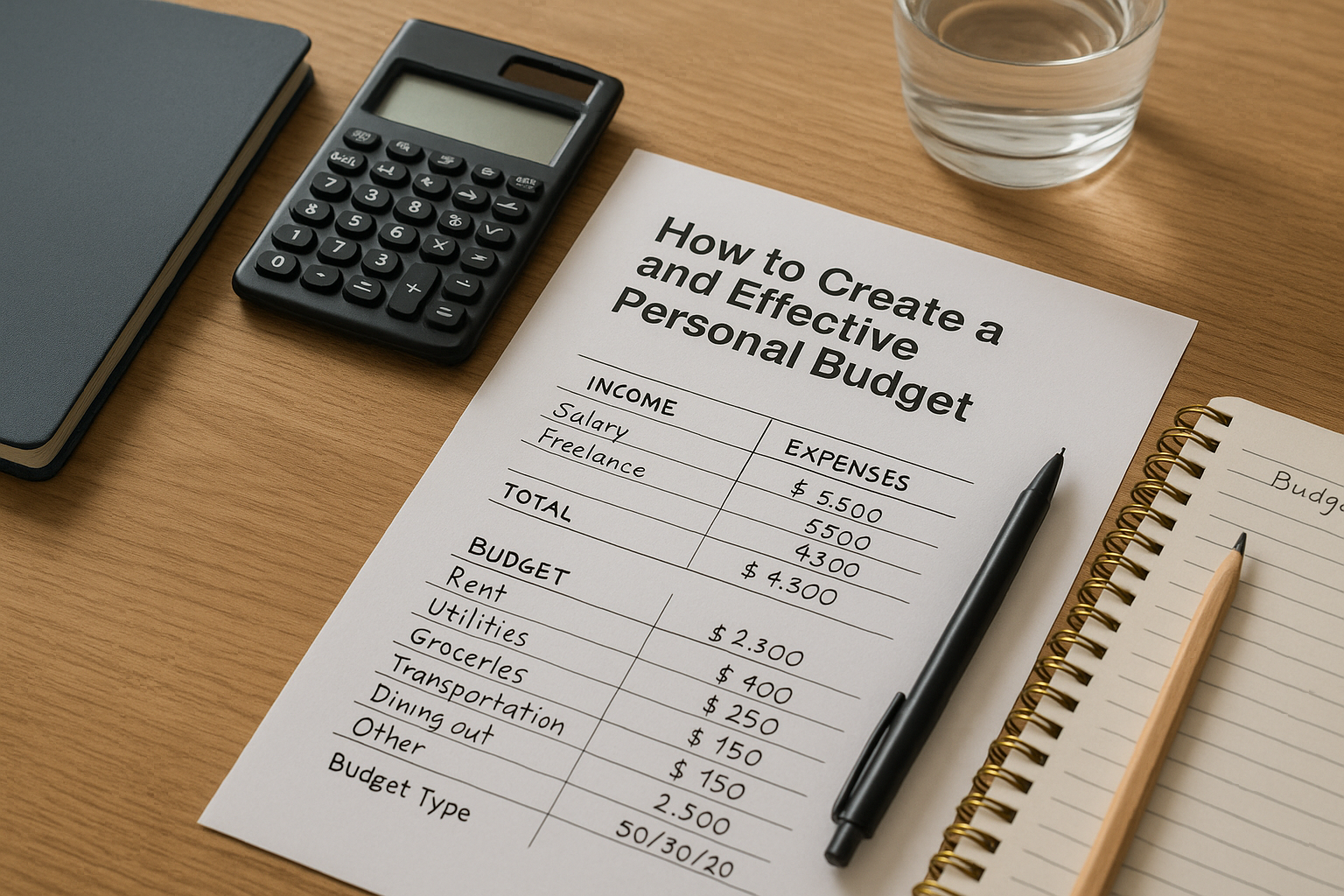

Step 1: Know Your Income

Start with your net income, which is the money you actually receive after taxes and deductions.

Include:

- Salary or wages

- Freelance or side job income

- Rental income

- Child support or government benefits

If your income varies from month to month, calculate an average of the last 3–6 months to estimate.

Step 2: List All Monthly Expenses

Track all your monthly expenses—both fixed and variable.

Fixed expenses:

- Rent or mortgage

- Utilities

- Insurance premiums

- Car payments

- Loan repayments

Variable expenses:

- Groceries

- Gas

- Dining out

- Entertainment

- Personal care

- Subscriptions

Use your bank statements or a finance app to track average spending over the last 1–2 months.

Step 3: Categorize and Prioritize

Next, divide your expenses into categories and prioritize based on necessity.

Priority Categories:

- Needs (housing, food, transportation, insurance)

- Debts (credit cards, student loans)

- Savings (emergency fund, retirement)

- Wants (entertainment, dining out, shopping)

The key is not to eliminate all “wants,” but to balance them so you’re not sacrificing your financial stability.

Step 4: Choose a Budgeting Method

There’s no one-size-fits-all approach to budgeting. Choose a method that fits your lifestyle and mindset.

Popular methods:

1. The 50/30/20 Rule

- 50% for needs

- 30% for wants

- 20% for savings and debt repayment

2. Zero-Based Budget

- Every dollar is assigned a job (expenses, savings, etc.)

- Income – Expenses = $0

3. Envelope System

- Cash is separated into physical envelopes by category

- When an envelope is empty, no more spending in that category

Step 5: Use Tools to Stay Organized

Use digital tools to track your budget efficiently. Many are free and user-friendly.

Recommended budgeting apps:

- Mint – Easy to use, great for beginners

- YNAB (You Need A Budget) – Great for zero-based budgeting

- EveryDollar – Simple and clean interface

Or, you can stick to a spreadsheet or even pen and paper if you prefer a manual approach.

Step 6: Plan for Irregular and Annual Expenses

One of the most overlooked parts of budgeting is planning for non-monthly expenses. These can throw off your entire plan if you’re not prepared.

Examples:

- Vehicle maintenance

- Holiday gifts

- Medical expenses

- Annual insurance premiums

Tip:

Create a “sinking fund”—a small amount saved monthly in anticipation of these expenses.

Step 7: Track and Adjust Weekly

Budgeting isn’t a one-time event—it’s an ongoing habit. Regular check-ins help you stay accountable and adjust for unexpected changes.

Weekly:

- Review spending by category

- Adjust if needed

- Celebrate small wins

Monthly:

- Compare actual spending with budgeted amounts

- Tweak categories that are consistently off

- Revisit goals and update if necessary

Step 8: Include Financial Goals

Your budget should reflect your goals, not just your bills. Saving for a home, paying off debt, or taking a vacation? Build those into your plan.

Examples of budgeted goals:

- $200/month to emergency fund

- $100/month to travel savings

- $150/month extra toward debt

Make your goals visible—write them down, use a vision board, or set reminders on your phone.

Step 9: Don’t Aim for Perfection

Especially at the beginning, your budget won’t be perfect. That’s okay. The goal is progress, not perfection.

Expect to overspend in some categories. Expect to forget something. Expect to tweak the system. That’s all part of learning.

A Budget That Builds Confidence

A well-made budget doesn’t just organize your money—it boosts your confidence. Knowing you’re making smart financial decisions helps reduce stress and builds a foundation for everything from freedom to invest, to security in emergencies, to long-term wealth.

So take the first step: sit down, list your income and expenses, and start shaping the financial future you want.