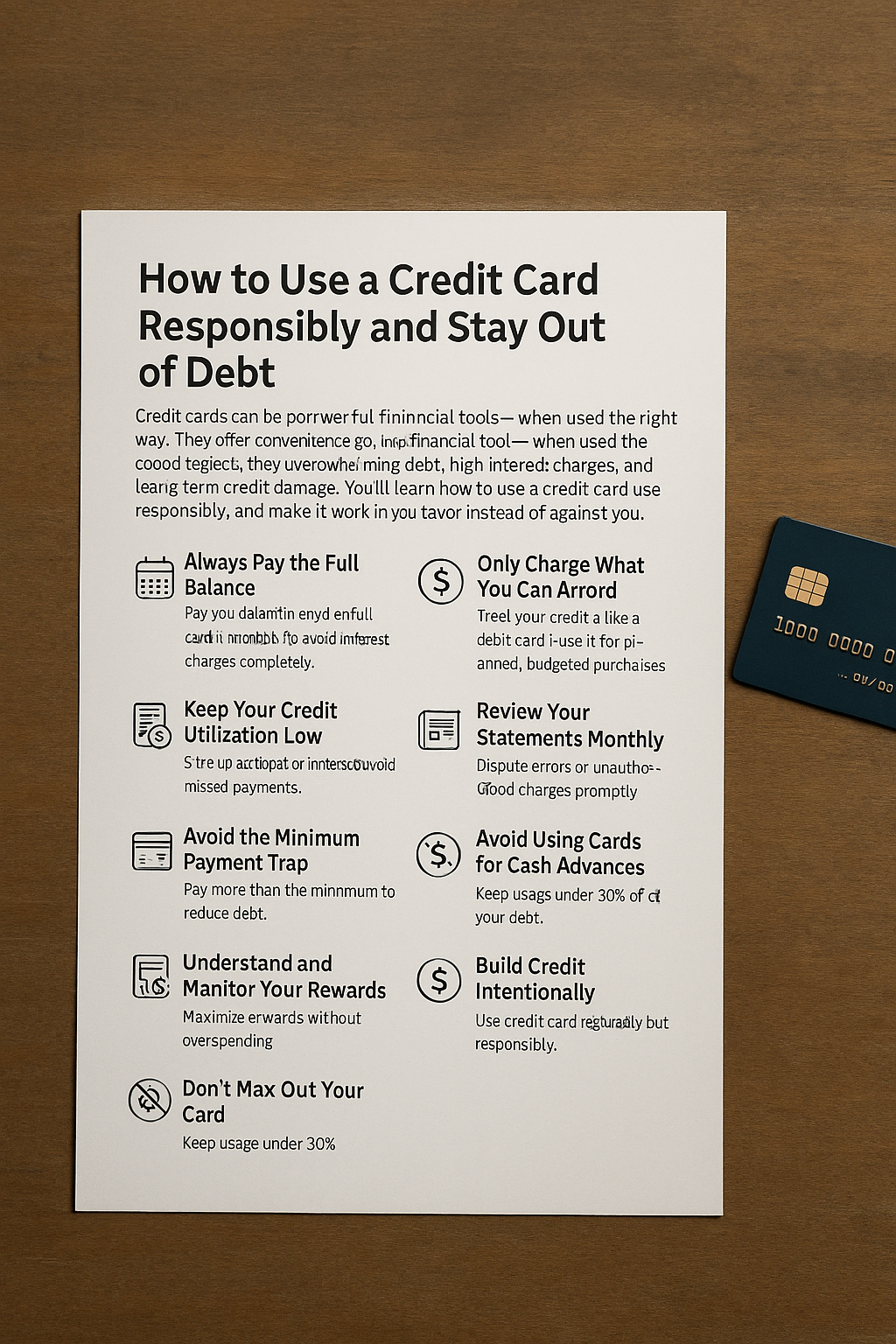

Credit cards can be powerful financial tools—when used the right way. They offer convenience, help build your credit score, and can even earn you rewards. But if misused, they can lead to overwhelming debt, high interest charges, and long-term credit damage.

In this guide, you’ll learn how to use a credit card responsibly, avoid the most common pitfalls, and make it work in your favor instead of against you.

Understand How Credit Cards Work

Before using a credit card, it’s crucial to understand what it is: a short-term loan that you’re expected to repay every month.

Key terms:

- Credit limit: The maximum amount you’re allowed to borrow.

- Statement balance: The amount owed for a specific billing cycle.

- Minimum payment: The lowest amount you must pay to keep the account in good standing.

- Interest rate (APR): The fee you pay for carrying a balance.

If you don’t pay your full balance by the due date, interest will begin to accrue—often at a high rate.

Tip 1: Always Pay the Full Balance

The most important rule of responsible credit card use is to pay your balance in full each month. This avoids interest charges completely.

Why it matters:

- Avoids debt accumulation

- Helps build a strong credit history

- Maximizes the benefits of cashback or rewards

Set up automatic payments or reminders to never miss a due date.

Tip 2: Only Charge What You Can Afford

A credit card is not extra income—it’s a payment method. If you wouldn’t be able to pay for something in cash or with your debit card, don’t charge it.

Practice this habit:

- Treat your credit card like a debit card

- Use it for planned, budgeted purchases only

- Avoid impulsive or emotional spending

Responsible usage means control, not convenience.

Tip 3: Keep Your Credit Utilization Low

Your credit utilization rate—the amount you owe versus your credit limit—plays a big role in your credit score. Experts recommend keeping it below 30%.

Example:

If your credit limit is $1,000, try not to use more than $300 at any given time.

Keeping your utilization low shows lenders that you’re not overly dependent on credit.

Tip 4: Pay on Time, Every Time

Your payment history makes up 35% of your credit score. Late payments can hurt your score and trigger late fees.

Stay organized:

- Set up autopay for at least the minimum payment

- Add calendar reminders

- Use budgeting apps with bill alerts

Even one missed payment can impact your credit for years.

Tip 5: Avoid the Minimum Payment Trap

Paying only the minimum amount may keep your account current, but the rest of your balance will continue to grow with interest.

What to do:

- Pay the full balance if possible

- If not, pay more than the minimum to reduce your debt faster

- Consider using the debt snowball or avalanche method for large balances

Tip 6: Understand and Monitor Your Rewards

Many credit cards offer points, cashback, or travel perks—but these rewards are only beneficial if you’re not carrying a balance.

Maximize rewards:

- Choose a card that matches your spending habits

- Redeem rewards before they expire

- Don’t spend more just to earn points—it defeats the purpose

A reward program should support your budget, not sabotage it.

Tip 7: Review Your Statements Monthly

Errors and fraudulent charges happen. Make it a habit to review your monthly statement and address issues promptly.

Check for:

- Charges you don’t recognize

- Duplicate transactions

- Subscription renewals you forgot about

Report fraud immediately to avoid liability and freeze the card if necessary.

Tip 8: Don’t Max Out Your Card

Using your full credit limit—especially often—can damage your credit score, even if you pay it off later.

Best practice:

- Keep usage under 30% of your limit

- Ask for a credit limit increase if your income rises (but don’t use it all!)

- Use multiple cards to spread out spending if needed

This keeps your credit profile healthy and improves your chances for future loans or rentals.

Tip 9: Avoid Using Cards for Cash Advances

Credit card cash advances often come with higher interest rates, no grace period, and additional fees. They’re one of the most expensive ways to borrow money.

Safer alternatives:

- Use emergency savings

- Borrow from family or friends

- Consider a personal loan with lower interest rates

Cash advances should be the last resort, not the go-to.

Tip 10: Build Credit Intentionally

Used properly, credit cards can help you establish a solid credit history, which opens doors for loans, mortgages, and better interest rates.

Do:

- Keep old cards open to build credit age

- Use your card regularly but responsibly

- Diversify your credit over time (loans, utilities, etc.)

Your credit score is a financial asset—protect it wisely.

Final Thoughts: Be the Master of Your Card, Not the Other Way Around

A credit card isn’t good or bad—it’s a tool. Like any tool, its impact depends on how you use it. Be intentional, stay organized, and view your card as a part of your financial strategy, not a shortcut or a trap.

With good habits, you can build credit, avoid debt, and enjoy the perks—without the headaches.