Everyone has dreams—whether it’s taking a trip across Europe, buying a cozy home, or starting your own business. But turning dreams into reality often requires one essential ingredient: money. The good news? With planning, discipline, and smart saving strategies, you can create a dedicated fund to achieve any goal, no matter how big it seems.

In this guide, you’ll learn how to create a savings fund tailored to your dreams, stay motivated throughout the process, and avoid common pitfalls along the way.

Why You Need a Dedicated Dream Fund

A dream fund isn’t just about saving money; it’s about giving your goals structure and a timeline. It helps separate your everyday expenses from long-term aspirations, making it easier to track progress and avoid dipping into the money meant for your future.

Benefits of Having a Dream Fund

- Keeps your goals visible and tangible

- Helps avoid using credit or loans

- Builds better financial habits

- Creates a sense of purpose and motivation

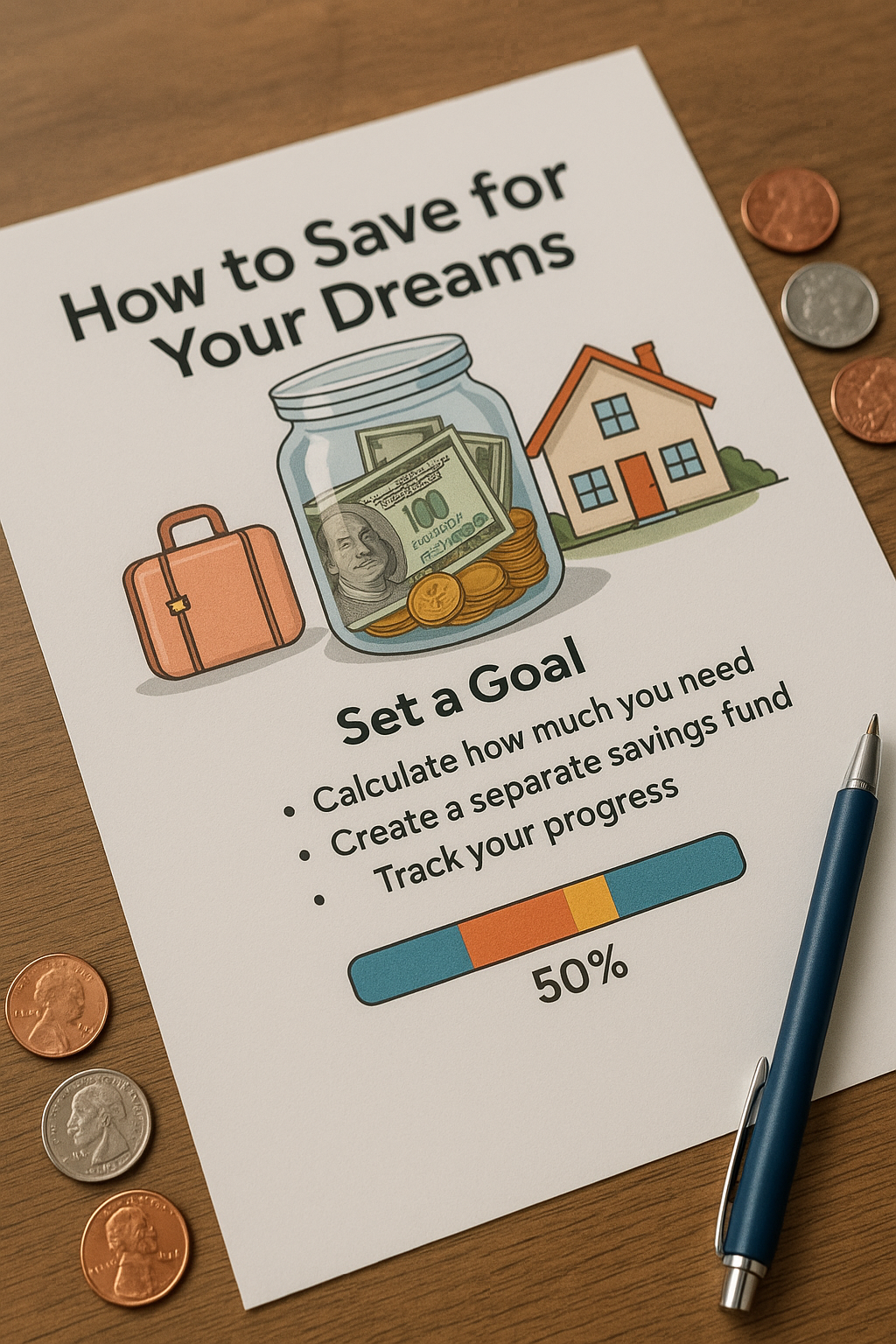

Step-by-Step: Building Your Dream Fund

Let’s break down exactly how to build a fund that works for your lifestyle and goals.

Step 1: Define Your Dream Clearly

What do you want to achieve? Be specific. Instead of saying “I want to travel,” say “I want to spend two weeks in Italy in 2026.” Clarity helps define the cost and time horizon.

Step 2: Estimate the Total Cost

Do some research. If your goal is travel:

- Include flights, accommodations, food, transportation, insurance, and spending money.

If your goal is buying a home:

- Estimate your down payment, closing costs, inspections, and moving expenses.

Write down the total number—it gives you a clear savings target.

Step 3: Set a Deadline

When do you want to achieve this goal? The timeline will help you determine how much to save monthly.

Example:

- Goal: $10,000 trip

- Deadline: 24 months

- Monthly savings needed: $10,000 ÷ 24 = $417

Step 4: Open a Separate Savings Account

Avoid mixing your dream fund with your emergency savings or daily expenses. Open a high-yield savings account, preferably one without debit card access, so you’re less tempted to touch it.

Step 5: Automate Your Savings

Set up automatic transfers from your checking to your dream fund every payday. Treat your savings like a non-negotiable bill.

Step 6: Track Progress Visually

Use a progress tracker—a spreadsheet, a savings app, or even a physical chart you can color in. Watching your savings grow keeps motivation high.

Step 7: Celebrate Small Milestones

Every time you reach a milestone (25%, 50%, etc.), reward yourself in a small way. This positive reinforcement helps you stay committed.

Ways to Boost Your Dream Fund Faster

If your current income isn’t enough to meet your savings goal on time, consider these methods:

Take on Freelance Work or a Side Hustle

Platforms like Upwork, Fiverr, or local gig apps can help generate extra cash quickly.

Sell Unused Items

Old electronics, clothes, or furniture can be turned into quick savings via online marketplaces.

Cut Non-Essential Expenses

Review your subscriptions, eating-out habits, and impulse spending. Redirect that money into your dream fund.

Use Windfalls Wisely

Put bonuses, tax refunds, or gifts straight into your fund. These can shorten your timeline significantly.

Tools and Apps to Help You Save

- Ally Bank or Marcus by Goldman Sachs: High-yield savings accounts with goal-tracking features

- YNAB (You Need a Budget): Helps assign every dollar a purpose

- Qapital: Automates savings based on personalized rules (e.g., round up purchases)

- Simple spreadsheets: Ideal for those who like manual control and visibility

Mistakes to Avoid

- Not Being Specific About the Goal: Vague goals lead to vague plans. Be detailed.

- Underestimating the Total Cost: Always overestimate slightly to account for inflation or price changes.

- Mixing Savings With Other Funds: Keep your dream fund separate to avoid accidental spending.

- Skipping Contributions: Even small consistent deposits are better than large inconsistent ones.

- Giving Up Too Soon: Setbacks are normal. Adjust, but don’t quit.

How to Stay Motivated

- Print a picture of your goal and keep it somewhere visible.

- Remind yourself why you’re saving.

- Tell someone about your goal for accountability.

- Visualize how you’ll feel once you achieve it.

Final Thoughts: Turn Vision Into Reality

Dreams feel distant until you start planning for them. A dedicated savings fund gives your vision structure, making even the most ambitious goal feel achievable.

Start with a clear goal, break it down into actionable steps, and stay consistent. Your future self will thank you for every dollar saved today.

Your dreams are valid—and with the right strategy, they’re entirely within reach.