Being in debt can feel like a heavy burden that never goes away. Whether it’s credit card debt, student loans, or personal loans, the constant pressure of repayments can be overwhelming. But the good news is that with the right strategy and mindset, it’s absolutely possible to get out of debt—and stay out—without giving up your quality of life.

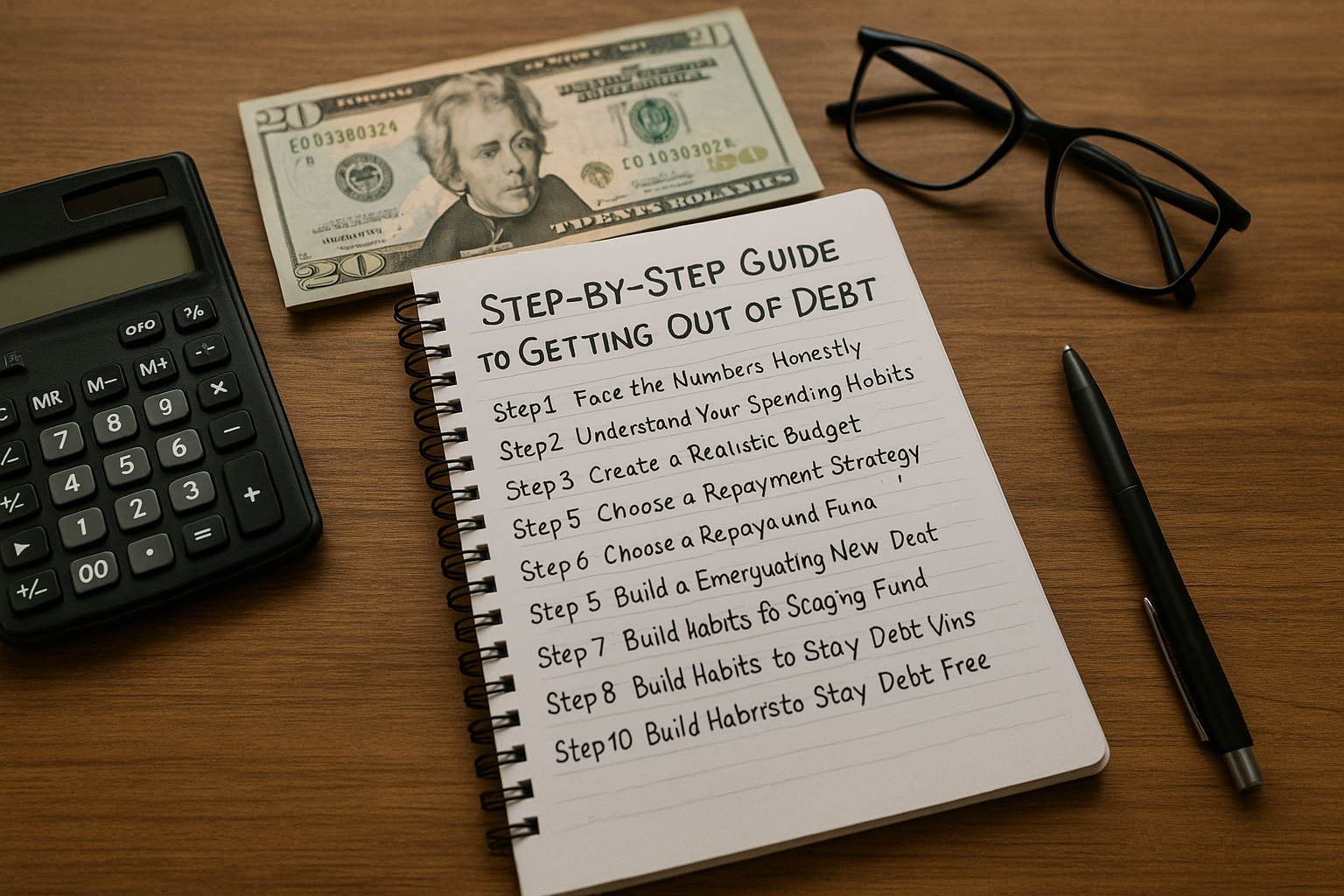

This article will walk you through a sustainable, step-by-step process to become debt-free for good.

Step 1: Face the Numbers Honestly

The first step to solving any problem is understanding it fully. Many people avoid looking at their debt because it causes anxiety, but clarity is key to taking control.

Make a list of all your debts:

- Who you owe

- Total balance

- Minimum monthly payment

- Interest rate

- Due dates

You can use a spreadsheet, notebook, or financial app to organize this information.

Step 2: Understand Your Spending Habits

Before you can redirect your money toward debt repayment, you need to know where it’s currently going.

Track all expenses for 30 days:

- Fixed expenses (rent, utilities, loans)

- Variable expenses (groceries, transport, entertainment)

- Discretionary spending (subscriptions, dining out)

Use this insight to identify non-essential spending that can be cut or reduced.

Step 3: Create a Realistic Budget

Now that you know your income and expenses, it’s time to build a budget that allows for consistent debt repayment.

Tips:

- Allocate money to essentials first

- Assign extra cash to a “debt repayment” category

- Use the 50/30/20 rule if you’re just starting out

- Automate payments for essentials to avoid late fees

Even $50 or $100 extra toward debt each month makes a difference over time.

Step 4: Choose a Repayment Strategy

There are two widely-used and proven methods to pay off debt strategically:

1. Debt Snowball Method

- Pay off the smallest debt first while making minimum payments on others.

- After one is paid off, roll that amount into the next smallest debt.

Why it works: Builds momentum and motivation with quick wins.

2. Debt Avalanche Method

- Focus on the debt with the highest interest rate first.

- Once that’s paid, move to the next highest rate.

Why it works: Saves more money in interest over time.

Pick the method that fits your personality—whether you need emotional motivation or want to maximize savings.

Step 5: Negotiate Better Terms

Many people don’t realize that creditors are often willing to renegotiate loan terms, especially if you’re a long-time customer or struggling financially.

What to negotiate:

- Lower interest rates

- Extended payment terms

- Waived late fees

- Debt consolidation

Be polite, explain your situation, and ask for options. You’d be surprised at what’s possible.

Step 6: Build a Small Emergency Fund

It might seem counterintuitive to save money while paying off debt, but an emergency fund prevents you from falling back into debt due to unexpected expenses.

Goal:

Save at least $500–$1,000 in a separate savings account.

Once your debts are cleared, you can focus on building a larger safety net.

Step 7: Stop Accumulating New Debt

You can’t get out of a hole if you keep digging. It’s essential to pause the use of credit while working on repayment.

How:

- Leave credit cards at home

- Remove saved cards from online shopping accounts

- Use cash or debit only

- Unsubscribe from marketing emails that trigger impulse spending

Discipline now leads to freedom later.

Step 8: Find Extra Income

Sometimes, cutting expenses isn’t enough. Increasing your income, even temporarily, can accelerate your debt payoff.

Ideas:

- Freelancing or gig work (Uber, Upwork, Fiverr)

- Selling unused items online

- Starting a side business or service

- Taking on a part-time job

Apply all extra income directly toward debt to maximize impact.

Step 9: Track Progress and Celebrate Wins

Debt repayment is a long journey. Celebrate small wins to stay motivated.

Track your journey:

- Create a debt payoff chart

- Use a progress-tracking app

- Share your goals with an accountability partner

Each balance paid off is a victory and a step closer to freedom.

Step 10: Build Habits to Stay Debt-Free

Once you’re out of debt, staying out requires strong financial habits.

- Keep a monthly budget

- Maintain an emergency fund

- Pay off credit cards in full each month

- Plan large purchases in advance

Debt freedom is not just a destination—it’s a lifestyle.

You Can Do This—One Step at a Time

Getting out of debt doesn’t require a big windfall or perfect timing. It requires a plan, consistency, and commitment. Start small, stay disciplined, and don’t let setbacks stop you. Financial freedom is within reach—and the relief you’ll feel when you make your last payment is worth every step.